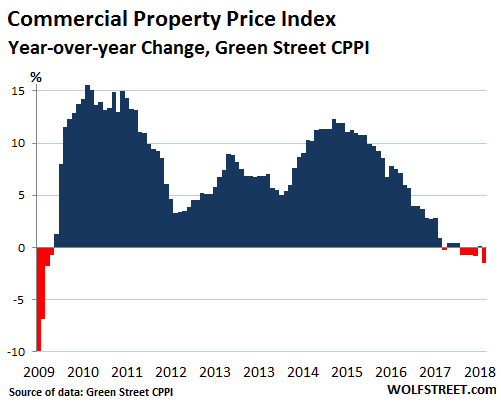

On the Bank side of the table J-yell(Janet Yellen) before stepping down as Fed chair stated that CRE prices look high, her statement was followed by J-Powl (Jerome Powell )and then a Golden Sachs analyst stated that property values may be 16% percent overvalued. A chorus from other banks said they were pulling back Tim Sloan, Wells Fargo CEO, US Bankcorp and KeyCorp all stated that they were pulling back from home bias valuations. Since 2017 Banks are small players in the current CRE lending cycle, private equity debt funds and REIT s hold dominant share. The effects of the home bias and the Fed losing control of gross capital flow to shadow banks who continue to lend even when the Fed tries to take away the punch bowl. In the commercial real estate debt game, bulls make money, bears make money and it appears that pigs get blankets. There is so much money in the pipeline that the gross flow of late-stage “shadow wealth” seeking yield will not begin to decline until 2020.

BASAR GLOBAL INSIGHTS ON COMMERCIAL REAL ESTATE

THE STEALTH BUBBLE 2018-2023

Article Index

-

- Basar Global Insights on Commercial Real Estate

- Global Capital Flow

- 2018-2023 Emerging Cities

- Home Bias Investing

- The Five Year Cre Investment Cycle for Top Global Cities 2015-2020

- China Cre Investment Value Shift

- Saudia Arabia Cre Value Investment Opportunity 2019-2026

- India Cre Global Investment Integration

- Asia Pacific Cre Investment Cycle

- Singapore Investment Market 2018-2022

- Malaysia Cre Market 2018-2023

- Thailand Cre Investment Market 2018 -2024

- Indonesia Cre Investment Market 2018-2023

- Western Asia Cre Investment Markets

- Brazil Cre Investment Market 2018-2023

- Africa Cre Investment Market Development 2019-2028

- Joint Ventures Global Investment Vehicle 2019-2023

- Blockchain Investment Tool 2021-2027

- European Cre Investment Market 2018-2023

- US Cre Investment Market Cycle 2016-2025

- The Stealth Bubble 2018-2023

- Global REITs and Infrastructure Investment Trends 2018-2024

- US Market Hedging Trends to Diversification

- Global Portfolio Diversification 2019-2024

In fact, Fed banks only control 4% percent of CMBS lending market while shadow bank funds control 45% percent. The shadow banks and low-interest rates have kept CRE valuations high both in the US and Europe. In most cases, the private debt funds interest rates were lower than the banks. This gave over-leveraged owners a chance to refinance the shadow wealth at lower rates. In Europe private debt funds are showing cracks, according to RCA, European CRE debt funds capital raise amounts have declined by 46% percent to $5.4B in 2019. According to PERE capital inflows to CRE debt funds across the board fell by 48% in 2019 after peaking at $39 billion in 2018.

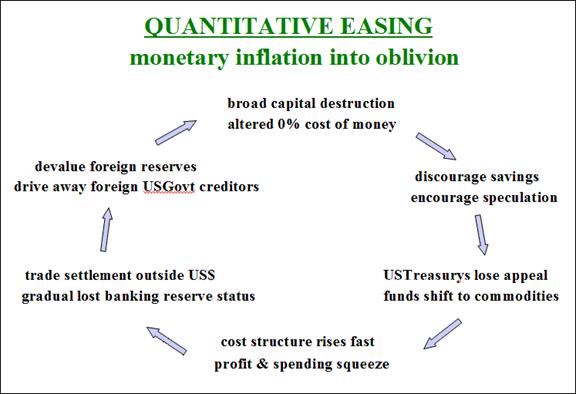

After the last “tamper tantrum” the Fed has led to a $4.2 trillion portfolio of United States Treasury debt and mortgage-backed securities as part of a strategy known as quantitative easing (QE). The majority of the QE capital flow has went to the top 1 percent and is concentrated in derivatives and speculative instruments which has no meaningful stimulus effect on employment, the feds 2% inflation targets or wages. Today,many of the theories presented by western economist over the last 30 years appear to be no more than mathematical mythology of the Trinity. Such as the 1.3 trillion dollar Trump tax break for corporations will provide the incentives for businesses to invest and create more jobs with a living wage.

In 2013 the fed set the stage for expansion of the global wealth gap when the head of the Federal Reserve voted to implement the asset injection in to the veins of the QE addicted speculators, he felt something in his gut that that they could have created perpetual speculation and leverage. J Powell said he voted in favor of the Fed’s final round of asset purchases, known as QE3, which begin September 2012, but he told his colleagues that he did so “with a certain lack of enthusiasm.” He was particularly concerned that the Fed’s bond buying would undermine financial stability.(NY Times 2019). Now the same economist wants sell you austerity after they have emptied the treasury with smoke and mirrors. In contrary to the IMF, World Bank the US needs to increase public spending with strategic targets that add value to the US infrastructure, human capital and not a speculative assets bubble based on falling wages.

In 2018 commercial real estate loans in the US reached a record of $4.3 trillion. This number is 11% greater than it had been during Dante’s peak of the prior commercial real estate bubble before it imploded into the financial crisis. In today’s US CRE core markets, leverage is everything. Many small banks are on the hook for shadow debt, see if they get a blanket.

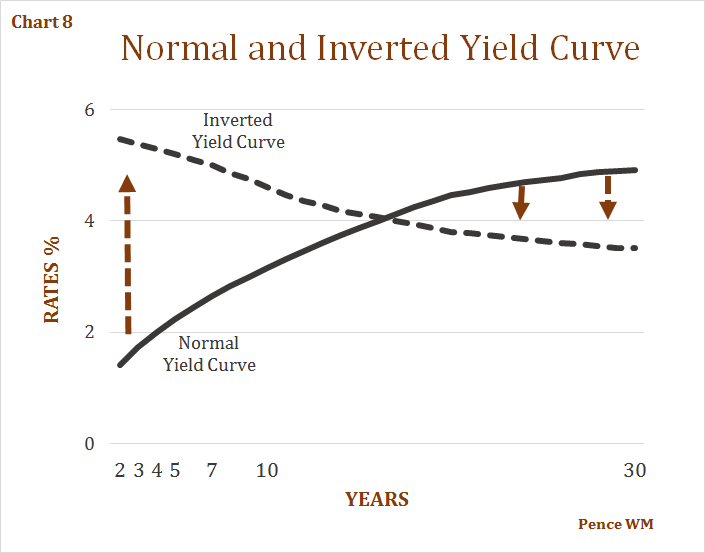

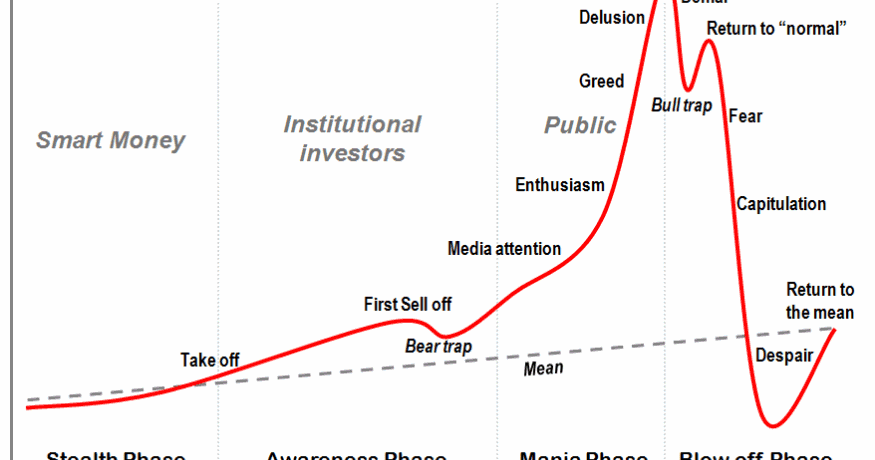

However, without a mutually beneficial trade policy, the mature economies face foreign capital outflows and a quantitative tapering process that will bring about a firm downturn and then a flattening stair step process which could last for 3-6 years in the top cities in the US and Europe. The shadow banks have created a “stealth bubble” by 2020-2021 which occurs when the flow of debt has concealed the true property value for years- become exposed, and the chicken.s comes home to roost. In a stealth bubble the key risk indicators do not show up on the radar, because the value creation (equity) does not exist, it is a form of shadow wealth(debt) created by an oversupply of capital flow(financial imbalances). As orderly increasing capital outflows gradually deflate property values. the CRE market feels normal. Another factor is in 2018 the majority of CRE loans were variable rate loans. It becomes a process of gradual asset deflation month after month, year after year, in essence, a “quiet exit”. But for the late cycle shadow wealth it becomes 12 noon for the shadow.

By mid 2020 property pricing cycle will be well beyond any possible sustainable value, therefore US exit visa are imminent. Foreign outflows from US property investments have begun, global investors are selling more U.S. commercial real estate than they bought in a quarter for the first time since 2013. International investors has amassed huge US CRE portfolios, foreign investors sold $13.4 billion of commercial real estate assets in the second quarter of 2019, During the same quarter, inbound capital flow from foreign investors purchased $12.6 billion of CRE assets this was a modest 9% decline from 2018, US total sales for second quarter was $127 Billion Dollars. according to data firm Real Capital Analytics.

One of the biggest foreign sellers during the second quarter was Ivanhoé Cambridge, the real-estate arm of Canadian pension fund Caisse de dépôt et placement du Québec has completed the sale of $2.2 billion worth of US properties, according to Real Capital.In the second quarter, Ivanhoé Cambridge sold two office towers in Seattle and its stake in Ritz Plaza, a 479-unit rental apartment building in Midtown Manhattan.

In the early stages of QE stealth bubble psychology the investor will watch the property value and transaction volume peak, then grind down slowly, then return to normal, then a pick up in declining pace, until pricing values return to the means, declining below 2012 numbers. As for late stage capital flow CRE cycle investors. European and Canadian investors are becoming active sellers, along with Asian investors who are making a cautious value shift with China to the east. “U.S. real estate pricing diversions are the results of intense late cycle speculation from shadow wealth investors.This give those investors holding exit visa’s an opportunity to cross the net border into liquidity, since the Feds decided to prop up the asset prices for another round of QE in late 2019.

B.M. Mansoor of Basar Global Group says” he would think that many US chief financial officer and portfolio managers are looking at ways to hedge their strategies. Money managers are looking for a downturn over the next two years. One thing you know is that during a downturn in the market that macro force will dominate the micro force very quickly. This will cause your portfolio to behave in a certain way. One would have to invest in the right assets and markets now by looking for certain patterns and trends. The key is to make the smart investment now in anticipation of what is to come in the next cycle by studying capital flow in context with investors demand trending markets and asset classes. According to Real Capital Analytics investors sentiments in the US market has declined slightly from 2018 from 77% percent to 65% percent when asked the question will you invest in 2019?

In the US inventories, retail space will increase and more malls will convert to warehouse space for e-commerce and more e-commerce will convert to retail in 2019.There are a number of US store closing and is expected to jump at least 33% in 2018-2019,to more than 12,000 and forecast that another 25 major retailers could file for bankruptcy. In 2019 is the year of joint venture as SWFs team up globally while the home team will be investing in liquid trading assets.

Pension funds and insurance companies together account for over half (51 percent) of total capital allocated to real estate by the $1 billion Club and above investors, based on a report by Preqin. Asset managers and private sector pension funds each account for 15 percent of total capital allocated to the asset class by Club Investors. Sovereign Wealth Funds (SWFs) in 2018 invested 36 billion into global real estate which returned 14.1% when portfolios expectations were 7.4% returns. SWFs have e a total capitalization 8.1 trillion dollars with average returns of 8.3 percent.