Singapore total investment sales for 2018 were S$32B a 9.3 percent decrease from the record S$35.14 in 2017. Singapore is one of the top countries in business openess and major player in outbound capital through its SWF GIC, CapitaLand and Temesak Platforms. On the home-front -the Singapore residential market is facing a slowing residential demand from pricing pressure. In Singapore 80 percent of population live in respectable government housing which is facing policy issues in 2019. The Singapore government would not let the free market run ahead of fundamentals. In 2018-the largest CRE transaction in Singapore was S$908M OEU Downtown bought by OEU C-REIT followed by PGIM Real Estate purchase of 78 Shenton Way for S$680M. There are US investment platforms are looking at Singapore office market in 2019.

BASAR GLOBAL INSIGHTS ON COMMERCIAL REAL ESTATE

SINGAPORE INVESTMENT MARKET 2018-2022

Article Index

-

- Basar Global Insights on Commercial Real Estate

- Global Capital Flow

- 2018-2023 Emerging Cities

- Home Bias Investing

- The Five Year Cre Investment Cycle for Top Global Cities 2015-2020

- China Cre Investment Value Shift

- Saudia Arabia Cre Value Investment Opportunity 2019-2026

- India Cre Global Investment Integration

- Asia Pacific Cre Investment Cycle

- Singapore Investment Market 2018-2022

- Malaysia Cre Market 2018-2023

- Thailand Cre Investment Market 2018 -2024

- Indonesia Cre Investment Market 2018-2023

- Western Asia Cre Investment Markets

- Brazil Cre Investment Market 2018-2023

- Africa Cre Investment Market Development 2019-2028

- Joint Ventures Global Investment Vehicle 2019-2023

- Blockchain Investment Tool 2021-2027

- European Cre Investment Market 2018-2023

- US Cre Investment Market Cycle 2016-2025

- The Stealth Bubble 2018-2023

- Global REITs and Infrastructure Investment Trends 2018-2024

- US Market Hedging Trends to Diversification

- Global Portfolio Diversification 2019-2024

WeWork announced early 2019 the official opening of its tenth location in Singapore, at 380 Jalan Besar in the city’s Kallang area.The new outlet will be located in the mixed-use complex ARC 380 near Farrer Park and will have capacity for over 380 members. While WeWork has a substantial presence in the city-state already. The 2019 Singapore market is expected to perform at 10-20 percent decrease from 2018.

Asia Pacific growth is expected to slow to 5.8 per cent in 2019, down from 6.3 per cent in 2018, due to uncertainty around the ongoing US-China trade tensions, a World Bank report in October 2019. In 2019 We-Works is facing challenges around the questions of leadership, sustainable business model, valuation and leverage. However Singapore is ranked the most competitive country in the world and Southeast Asia real estate markets led the world in commercial real estate transaction volume of $86 Billion US dollars in Q2 of 2019. With two notable transactions at a single location, Gaw Capital and Allianz closed on the office component of the Duo mixed-use property in Singapore. Also the partnership M+S Pte Ltd is selling the hotel component of the Duo mixed-use project for S$475 million to Singapore developer Hoi Hup Realty. M+S, the national joint venture between Malaysia and Singapore, confirmed that it has agreed to sell all the shares of its wholly-owned subsidiary, Ophir-Rochor Hotel Pte Ltd (the developer and owner of Andaz Singapore) to Hoi Hup. The proposed S$475 million offer for the 342-room luxury hotel works out to S$1.39 million per key.

On a per-key basis, The Westin Singapore in Asia Square (in Marina Bay) still holds the record; it commanded S$1.5 million per room in 2013, when it was sold to Japan-based developer Daisho Group. In the same year, hotel-cum-retail asset Grand Park Orchard was bought for S$1.16 billion by Bright Ruby Resources, an entity controlled by a Du family in China. Its 308-room hotel, excluding the retail podium Knightsbridge, was estimated to have fetched S$364 million or S$1.4 million to S$1.5 million per room, Savills reported in 2013.

The Business Times had reported in February that a potential buyer for Andaz was RB Capital, which was then conducting exclusive due diligence, and possibly negotiating to purchase the hotel for between S$470 million and S$480 million.

We like REITs in Singapore for 2019 for example: If a global investor had invested in CapitaLand Commercial Trust (CCT) during its IPO, his initial investment of $1,000 would’ve grown to $1,880 (+88% in capital gains) as at 31 Jan 2019. On top of that, he would have collected total dividends of $1,160 (+116% in dividends). $1,000 investment in Suntec REIT would’ve turned into $1,930. Including dividends, every $1,000 would cumulatively become $3,220. The Singapore REIT that has returned the most so far is Ascendas REIT. Since 2002, every $1,000 investment in AREIT would’ve turned into $3,110. Including dividends, every $1,000 would cumulatively become $5,510 not bad rate of return for Starbucks money invested.

Outisde of Singapore REIT opportunities a robust rate of e commerce consumption of the region is driving increasing investor interest into data centers and logistics in Asia Pacific. These sectors will continue to expand, with significant capital flow targeting emerging markets like China, India and Indonesia. Meanwhile, logistics hubs in major cities are growing. As an example, the logistics market in Sydney increased seven-fold between 2015 and 2017.” In Indonesia Thailand, Vietnam, and the Philippine offshore capital flow is juicing the CRE cycle.

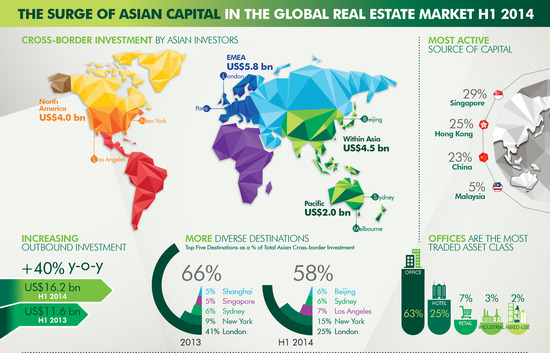

Asia Pacific countries all offer tremendous value creation for global investors as well as risk for portfolio managers.For the portfolio managers the idea here is to find patterns in CRE cycles that create downturns and expose capital to long-term risk. In the Asia Pacific we will look at capital flow in Singapore, Japan, Australia, South Korea , Indonesia and you will conclude your result. Asia Pacific a market with strong growth and a focus on core assets and markets. Japan market face challenges annual transaction volume dropped 26% percent to $28.8B according to RCA. Tokyo experience the slowest activity since 2009. A 10% percent year over year drop in transaction volume, with a total of only 4 cross border transaction closed in Tokyo in 2018 according to PERE. The lowest deal count since 2009.The average office yield was 3.4%-retail 3.4% and industrial was 4.49% percent.There was also a decline in lending the total real estate financing was $710 billion However the hotel markets in both Japan and Australia have strong hotel pipelines emerging. In Australia transaction volume volume was $28.8B tied with Japan. The office market peaked in Sydney and Melbourne at 50% percent higher than 2008 and transaction volume expected to dropped 10-20 percent in 2019 . Singapore’s sovereign wealth fund, GIC, announced that it has set up a A$2 billion ($1.44 billion) unlisted trust with Australian REIT, Dexus, to invest in logistics properties down under.There are many global investment opportunities in Asia Pacific region which are at various stages of the CRE investment cycle.