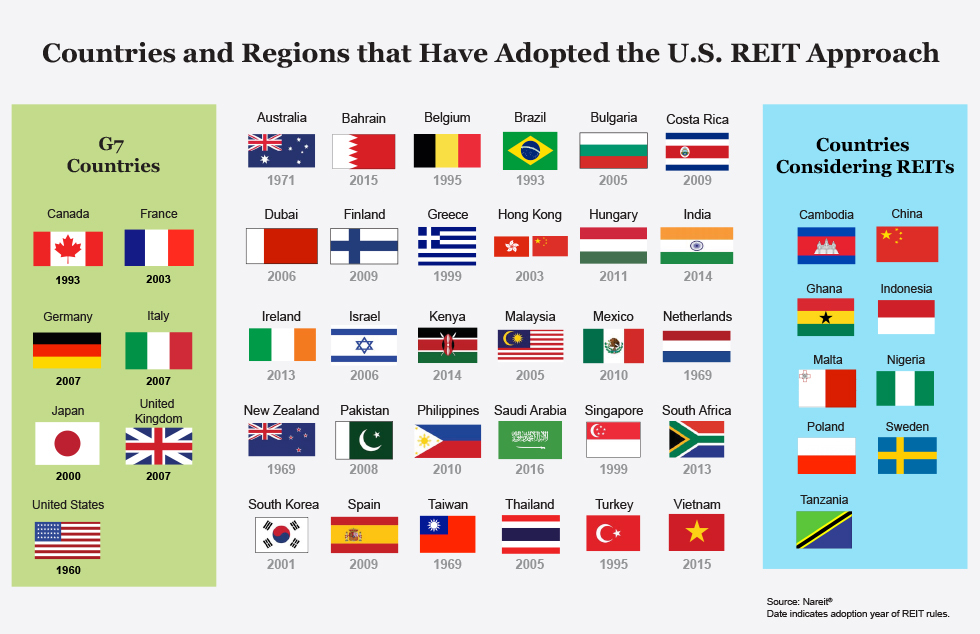

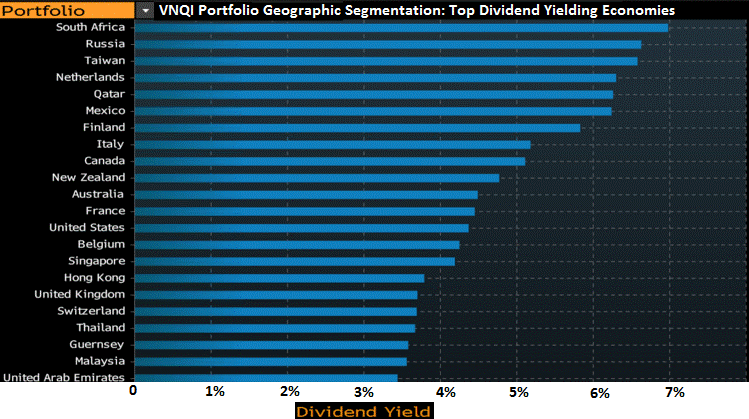

International real estate belongs in a well-diversified portfolio. Global acceptance of the REIT structure is increasing access to previously inaccessible but highly desirable countries. It is also facilitating the development of robust financial products that offer the average investor exposure to this important asset class. The end result, you get the opportunity to become a sophisticated, international real estate investor without ever having to experience lack of access to liquidity!

Global Diversification Solution

Important Disclosures

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Past performance is no guarantee of future results. This information is not intended to be a substitute for specific individualized tax, legal or investment planning advice. Where specific advice is necessary or appropriate, Basar Group recommends consultation with a qualified tax advisor, CPA, financial planner or investment manager. International investments involve additional risks, which include differences in financial accounting standards, currency fluctuations, geopolitical risk, foreign taxes and regulations, and the potential for illiquid markets. Investing in emerging markets may accentuate this risk.Diversification strategies do not ensure a profit and do not protect against losses in declining markets.