-

- Basar Global Insights on Commercial Real Estate

- Global Capital Flow

- 2018-2023 Emerging Cities

- Home Bias Investing

- The Five Year Cre Investment Cycle for Top Global Cities 2015-2020

- China Cre Investment Value Shift

- Saudia Arabia Cre Value Investment Opportunity 2019-2026

- India Cre Global Investment Integration

- Asia Pacific Cre Investment Cycle

- Singapore Investment Market 2018-2022

- Malaysia Cre Market 2018-2023

- Thailand Cre Investment Market 2018 -2024

- Indonesia Cre Investment Market 2018-2023

- Western Asia Cre Investment Markets

- Brazil Cre Investment Market 2018-2023

- Africa Cre Investment Market Development 2019-2028

- Joint Ventures Global Investment Vehicle 2019-2023

- Blockchain Investment Tool 2021-2027

- European Cre Investment Market 2018-2023

- US Cre Investment Market Cycle 2016-2025

- The Stealth Bubble 2018-2023

- Global REITs and Infrastructure Investment Trends 2018-2024

- US Market Hedging Trends to Diversification

- Global Portfolio Diversification 2019-2024

BASAR GLOBAL INSIGHTS ON COMMERCIAL REAL ESTATE AND CAPITAL FLOW

BASAR GLOBAL INSIGHTS ON COMMERCIAL REAL ESTATE

Article Index

5 Year REPORT: Emerging Tech Cities, Capital Flow, Home Bias Investing, CRE Cycles, Shadow Wealth, Logistics, REITs, Infrastructure, Hotels, Joint Ventures, Mixed Use Development, Blockchain and Portfolio Diversification

Basar Group Investment advisory is focused on research and global capital flow at all stages of the real estate cycle. It is our view to see the world as a single economy evolving through a dynamic interplay. The current core asset investment model in the US and Europe is evolving through the early stages of a gradual declining asset valuation- a deflating stealth bubble. The traditional investment trend is for global investors to concentrate most of the capital flow in major markets while ignoring the healthy expansion of capital into emerging GDP. Seventy percent of global real estate value is concentrated in the major cities of the of G-7 nations. Our focus of this report is on cities that are creating sustainable value creation. The traditional investment cycle goes through a cyclical process of boom and bust of the circle seven. However, the current 11-year cycle has been stimulated by developed nations (QE) monetary policies, foreign investors, home bias and shadow banking. One of the unforeseen catalysts for the next recession is lack of capital deployment to assets that create sustainable value(financial imbalances).

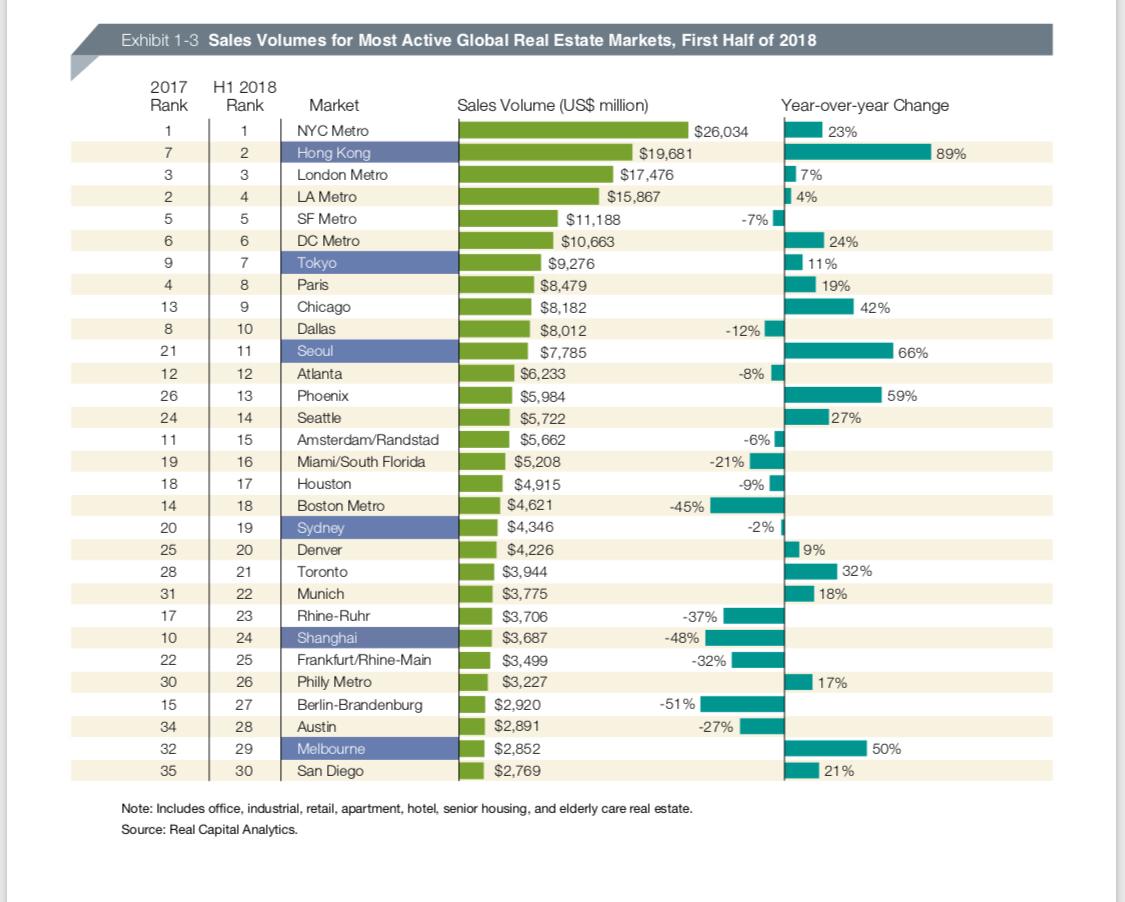

The total transaction volume for global commercial real estate was 736 billion US dollars for 2018.The US market represented 51% percent of the global CRE transaction volume. The majority of deal flow was invested in remnants of core assets and secondary markets driven by cross border mega deals, shifting to infrastructure and logistics investment strategies of transaction data driven e commerce economies.The static nature of the real estate industry has directed global investors to parked their risked adjusted capital in a few prime locations. The investment community in mature economies has been compliant to “home bias” for decades meaning the industry has become passive to global financial integration and the quantitative realities of balance yield investing. In 2019 the Goldman Sachs look into various historical catalyst or drivers of recession they included oil shocks, industrial shocks, inflation leading to aggressively rising rates, rising rates, fiscal tightening, and financial imbalances.

The views expressed in this commentary are the personal views of the authors researchers, or speakers and do not necessarily reflect the views of The Basar International Group Inc. (together with its affiliates, “Basar Group”). The views expressed reflect the current views of the speaker as of the date hereof and Basar International Group undertakes no responsibility to advise you of any changes in the views expressed herein.

Neither this research, post, nor the podcast nor any of the information contained herein or therein constitutes an offer to sell, or a solicitation of an offer to buy, any security or instrument in or to participate in any trading strategy with any Basar Group funds or other investment vehicle.

Past performance is not indicative of future results and there is no assurance that any Basar International Group fund will achieve its objectives or avoid significant losses. This report, blog or podcast may contain forward-looking statements; such statements are subject to various risks and uncertainties.

For information about Basar International Group’s business, is private company with family office investment capital. For additional information, see Basar International Group or basarint.com.