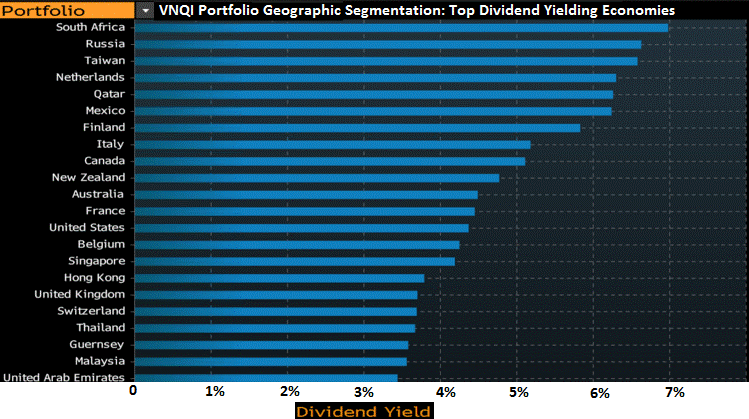

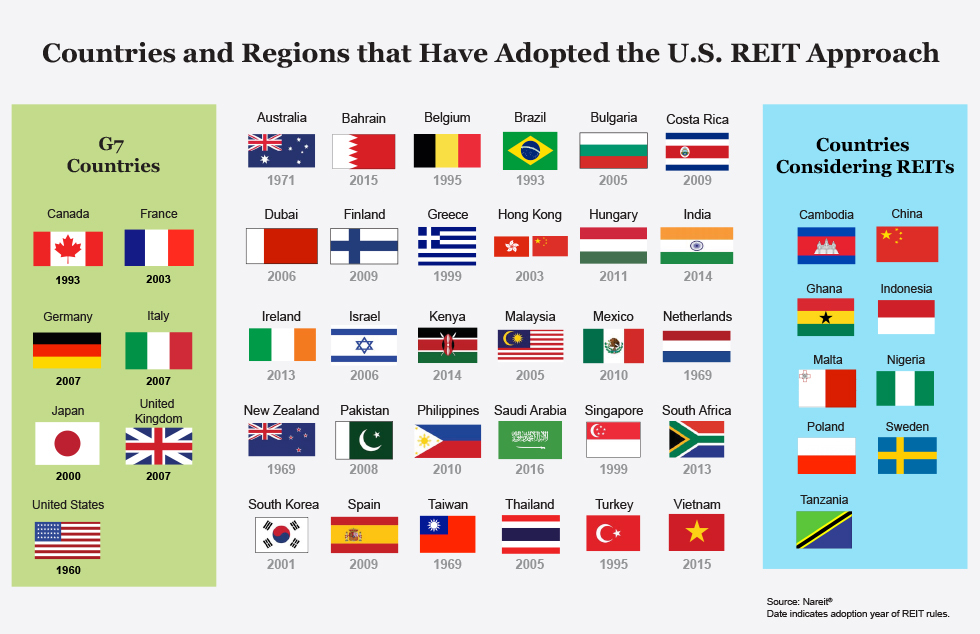

On global diversification solutions, we see protectionist threats as largely negotiating tactics, while Chinese reforms, Indonesian infrastructure or hotels, Singapore office, mix use, Dubai(tourism) hotels, US Infrastructure, Saudi hotels or Infrastructure, South African office or storage, Qatari Industrial offer strong dividends.The REIT sector has provided consistently strong investment returns. Global REITs have been the top performing asset class in South Africa in six of the past fourteen years,”REITs offer a contrarian value investment outlook which support equities such as REITs and listed real estate development funds.Emerging economies are adding value and yield to real estate and infrastructure assets at a higher rate than most develop countries. Real estate has long been one of the world’s most reliable stores and creators of wealth. A recent study by Dimensional Fund Advisors (“DFA”) found that non-U.S. REIT returns over the last 15 years were almost 14% per year . These are healthy returns for any market. Of course, past performance is no guarantee of future results.Growing economies around the world are seeing unprecedented investments in construction to support their commercial ambitions and increased urbanization. REITs and REIT-like investments are helping them to find the money for that growth.The populations of most developed countries are aging which is increasing the demand for investments that produce relatively high current yields. Basar Group is a value/growth investors so we look at cycles and trends such as immigrant population in countries such as Saudi,UAE, Qatar,Oman and Singapore. All of these countries have strong resources, immigration trends and strong value added infrastructure development cycles.The nation of Oman is fastest growing up 5% and the Orx Fund(Muscat Bank Fund) is returning above 10% in 2018. UAE was rated as the second best place in the world to live in 2019,with 80% of its population are immigrants with high tech cities.Saudi a G-20 nation with strong banks it has 10 million immigrants expanding tourist development the Grand Mosque of Mecca with 2 million visitors yearly. Singapore has strong immigration, rated as the most competitive place to do business and the best place to live. All of these countries have strong integrated financial systems and most have dollar based economies thru natural industrial resources and tourism which helps when it comes time to exit. REITs and REIT like structures typically pay out a substantial percentage of their income in dividends.

Global Growth Solutions- REIT

Global Diversification Solution

International real estate belongs in a well-diversified portfolio. Global acceptance of the REIT structure is increasing access to previously inaccessible but highly desirable countries. It is also facilitating the development of robust financial products that offer the average investor exposure to this important asset class. The end result, you get the opportunity to become a sophisticated, international real estate investor without ever having to experience lack of access to liquidity!

Important Disclosures

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Past performance is no guarantee of future results.

This information is not intended to be a substitute for specific individualized tax, legal or investment planning advice. Where specific advice is necessary or appropriate, Basar Group recommends consultation with a qualified tax advisor, CPA, financial planner or investment manager. International investments involve additional risks, which include differences in financial accounting standards, currency fluctuations, geopolitical risk, foreign taxes and regulations, and the potential for illiquid markets. Investing in emerging markets may accentuate this risk.Diversification strategies do not ensure a profit and do not protect against losses in declining markets.