Capital Gains Solutions

(defer, reduce and eliminate)

(defer, reduce and eliminate)

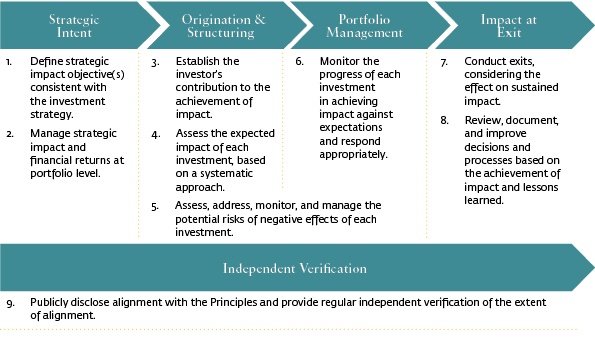

For those home bias investors seeking direct equity investments and sustainable value creation, we offer our Ghaf Tree Fund and Value Impact Fund which produces returns that are on par or above many comparable investment vehicles. Our capital raise for both funds is to be deployed in Philadelphia, Washington DC and New York.These cities keep demand for multifamily rental high and provide downside protection from volatility which effect other markets that lack employment diversity and are without high barriers to entry. The 24/7 nature of the northeast corridor has global appeal and our inspirational value added conversion design approach helps to maintain transactional liquidity to investors. The Ghaf Tree is a tree that can survive harsh desert environments without water and qualified opportunities zones (QOF) are areas with value that has been starve of capital flow and leverage.The objective of the Ghat Tree Fund is strategically manage asset risk and create value through rehab existing buildings and land lots which we control and others in the process of acquiring. The social impact is sustain by utilizing the IFC 9 principles of impact investing.The capital gains deference, reduction, and elimination happens in stages over a one year to ten year period”. Please see Chart on Capital Gains Deferred, Reduced,Eliminated

The value creation emerges from value added design, transparent, sustainable socially and economic practices based on the world banks 9 principles of impact investing. The practice involves exposing a broader population to capital allocation while sustaining prior capital gains, transparency through social, environmental and economic transformation. By deploying capital gains earned from the sale/exchange of any asset (real estate,stocks, bonds. art, bitcoin, etc.) into our Ghat Tree Impact Fund or a (QOF), investors are able to defer, and potentially reduce, capital gains taxes. An additional tax benefit to be aware of is the ability to exclude all taxes on capital gains earned on interest in the opportunity fund if held for 10 years.

Basar Groups capital gains strategy and our inspire mix of unique design and prefab development elements support our value added strategy of bringing projects in on time and on budget.

The Ghaf Tree Fund development project use state of the art prefab concrete slab and panel applications.The scope of projects and exit strategies are often targeted for the various stage of the real estate investment cycle. We utilize impeccable design elements and a plethora of amenities to foster a modern lifestyle and strong social impact on our communities living spaces.

The Ghaf Tree fund acquisition strategy is middle market allocation of $15 to 100 million dollars seeking under valued urban and sub-market land, office, retail and warehouse conversion spaces. We work diligently to earned the trust and confidence of our clients through our unwavering commitment to always act in their best interest and by consistently achieving attractive returns. We are completely transparent and acknowledged for the high quality, timeliness and detail of our investor reporting. But strategy is rather to achieve the highest returns in the shortest possible time period. For global investors both of our funds are shariah compliant impact funds each exit benefit our philanthropic investing component and the planting of the ghaf tree symbolizing human survival, adaptation and growth towards excellence.