Basar International Group is a global commercial real estate company focused on off market private sales and investment banking. Our integrated global team has 90 years experience and is focused on advisory research, private CRE sales, JV development and venture capital technology funding for global investors. We are a disruptive source of over 100 billion dollars in private real estate investment opportunities annually. We are global leaders and strategist for unsolicited acquisition of off market hotel assets. Basar Group is developing a transaction marketplace subscription platform for research and the private sale of commercial real estate assets. Our investment fund approach is value investing and delivers contrarian impact results and sustainable value. We offer our investors global solutions to portfolio diversification.One of the goals of our research is to benefit every investor to become more aware of global real estate cycles, capital flow, shifting investment markets and trends.

Creating Value Through Results

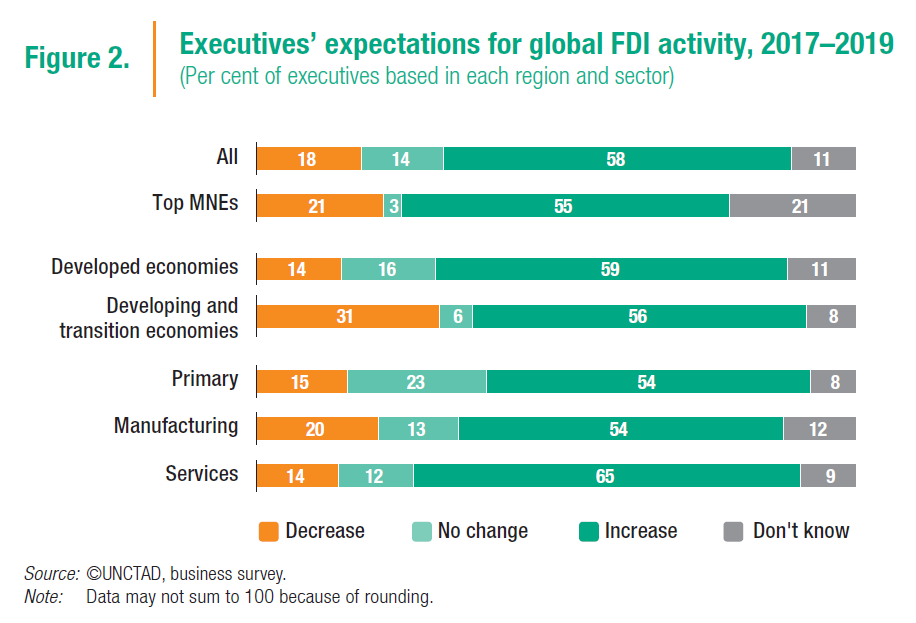

Basar Group investment advisory is focused on research and global capital flow at all stages of the commercial real estate cycle. It is our view to see the world as a single economy evolving through a dynamic interplay. We serve institutional investors whose investment cycle is 5 years or longer. We are an insight investment firm who serve private equity, sovereign wealth funds , family office and individual investors. Seventy percent of global real estate value is concentrated in the major cities of the G-7 nations. Our focus is on emerging global cities that are creating sustainable value. The static nature of the real estate industry has directed global investors to parked their risked adjusted capital in a few highly leveraged prime locations. The investment community in mature economies has been compliant to “home bias” for decades meaning the industry has become passive to global financial integration and the quantitative realities of balance yield investing. Our capital flow research highlight a number of global trends around the 4.0 Industrial Revolution such as infrastructure, logistics, hotels, G-5 office, REITs, joint ventures, prop-tech, blockchain and global portfolio diversification.

The perception or recognition of the opportunity is the key investment driver of real estate value. Global fund managers must remember when considering diversified investing and global financial allocation- that there is no apparent distinction between those factors that create value and those that destroy value, although there are variations in the magnitude of impact.

Global Economic Outlook

GHAF TREE FUND - OPPORTUNITY ZONE FUND

The Ghaf Tree Impact Fund is an Impact Opportunity Zone Fund to serve the community in blighted neighborhoods that has been left underserve and dormant of capital investment. Opportunity Zone allows investors to receive full tax benefits for the deployment of capital gains to transitional neighborhoods for a ten year period. There is $6.1 trillion of individual($3.8 trillion) and corporate ($2.3 trillion) unrealized capital gains that can be deployed into opportunity funds.

OFF MARKET PRIVATE SALES

Research targeting fund managers private equity,swf’s,family office-developers- investment sales -advisory office-multifamily-logistics-hotels-infrastructure markets-global tier cities-emerging market cities cre funding-debt-green loans-sukuk-bond funding global tier cities-emerging market cities-blockchain.

AFRICA CRE INVESTMENT MARKET DEVELOPMENT 2019-2028

African economies will offer commercial real estate investors the greatest value creation known to man since Mansa Musa of Mali change the value of gold throughout the world through charity. The continent will grow to a $12 trillion GDP by 2030 and population of 1.2 billion will grow to 42 million by 2050.

EUROPEAN CRE INVESTMENT MARKET 2018-2023

EU-London CRE Markets In Europe the primary investment FDI target will be Germany and Paris for 2019 and specifically the office and logistics properties in Frankford. London and the EU CRE markets face challenges. London with capital exit of US banks $700B in assets via Brexit and EU with the 46% percent drop in capital raise from PE shadow debt funds.

US CRE INVESTMENT MARKET CYCLE 2018-2024

The commercial real estate(CRE) markets in North America are stable but rather static, noting that transaction volume was up only 0.6 percent year-over-year. Although (2019) New York remains a top target for capital, investment -actually declined by 3.4 percent in 2018.

GLOBAL REITs AND INFRASTRUCTURE INVESTMENT TRENDS 2018-2024

Basar Group (BGG) sees REITs as the primary global vehicle for smaller US funds to participate in global diversification of commercial real estate assets. REITs can expand and diversify the investor pool to move beyond core in search of yield.

US MARKET HEDGING TRENDS TO GLOBAL DIVERSIFICATION

In 2018 -2024 global diversification is dominating the capital flow in search of value- is headed to the east. Private equity and SWF’s has already launched a number of large capital platforms and funding vehicles targeting Asia Pacific and emerging markets.