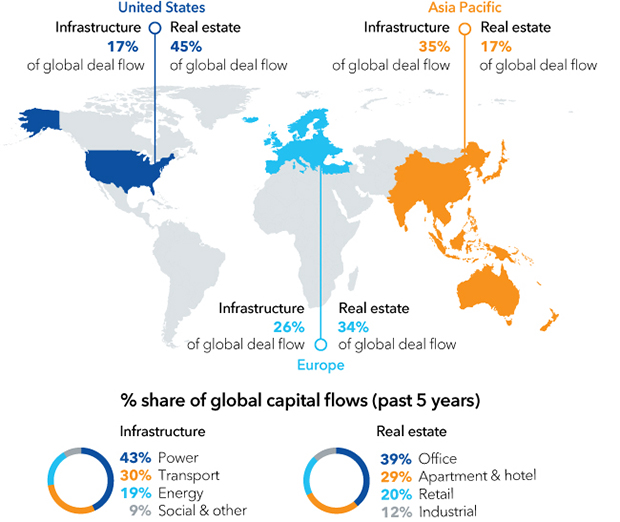

The dominant trend for sovereign wealth will be to invest in listed companies including REIT s. In 2019 middle east SWF’s will be going into debt equity, global logistics and joint venture partnerships in the late stage of real estate cycle. Infrastructure REIT s will attract investors in 2019 these REIT s own and manage infrastructure real estate and collect rent from tenants that occupy that real estate. Infrastructure REITs’ property types include fiber cables, wireless infrastructure telecommunication towers and energy pipelines.There are significant opportunities to provide capital and monetize real estate assets through the acquisition of land, leasehold interests and other real-estate infrastructure opportunities in 2019 for the long-term global investors seeking yield in the US CRE market.

BASAR GLOBAL INSIGHTS ON COMMERCIAL REAL ESTATE

GLOBAL REITs AND INFRASTRUCTURE INVESTMENT TRENDS 2018-2024

-

- Basar Global Insights on Commercial Real Estate

- Global Capital Flow

- 2018-2023 Emerging Cities

- Home Bias Investing

- The Five Year Cre Investment Cycle for Top Global Cities 2015-2020

- China Cre Investment Value Shift

- Saudia Arabia Cre Value Investment Opportunity 2019-2026

- India Cre Global Investment Integration

- Asia Pacific Cre Investment Cycle

- Singapore Investment Market 2018-2022

- Malaysia Cre Market 2018-2023

- Thailand Cre Investment Market 2018 -2024

- Indonesia Cre Investment Market 2018-2023

- Western Asia Cre Investment Markets

- Brazil Cre Investment Market 2018-2023

- Africa Cre Investment Market Development 2019-2028

- Joint Ventures Global Investment Vehicle 2019-2023

- Blockchain Investment Tool 2021-2027

- European Cre Investment Market 2018-2023

- US Cre Investment Market Cycle 2016-2025

- The Stealth Bubble 2018-2023

- Global REITs and Infrastructure Investment Trends 2018-2024

- US Market Hedging Trends to Diversification

- Global Portfolio Diversification 2019-2024

Many alternative investment asset classes represented in P&I annual survey of the largest U.S. retirement plans exhibited growth in the 12 months ended Sept. 30. Among defined benefit plans in the top 200 retirement systems, energy and infrastructure investments had the greatest increases, up 40.8% to $32.1 billion and 24.2% to $28.7 billion, respectively, albeit from small bases. Growth rates for private equity and real estate equity in the survey period.

The US office markets will attract a solid amount of new SWFs from Central Asia seeking to increase their portfolio performance in tier one property markets in 2019. However many tier one markets are already showing signs of cracks and buyers are looking to insulate themselves from the downturn. Green Oak partners a New York-based PE firm has historically spent most of its capital in tier one New York, San Francisco, Los Angeles, and Boston, it will also target other major cities, including Seattle, Washington, and Miami. All are more likely to be resilient in a downturn than less populated areas states Soni Kasi General Partner”.

NYC-Hudson Yards Related and Oxford Properties $20B project

New York will do fine as tech companies expand their presence in the office market and WeWorks expand there service to larger companies. The challenge for New York core investors will be the process of absorbing the square footage of office and residence of the $20 billion dollar Hudson Yard project. US Tier two apartment markets will attract some off-market club deals but the larger portfolio and mega trades exceeding one billion dollars will be hard to find for foreign pension funds in 2019. In 2019 long term investors will have an appetite for apartment portfolio investments. Lone Star sold 6000 apartments to Kushner Companies for $1.1 billion in early 2019.

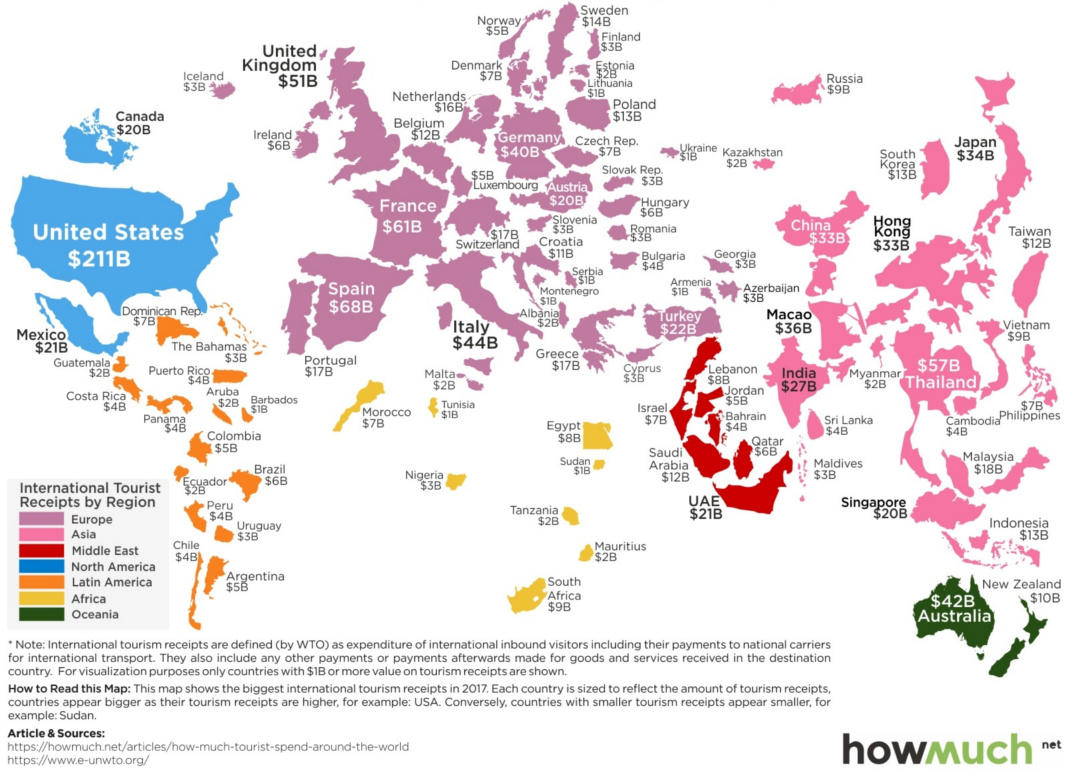

After the trade war liberalization of China services sectors and capital flow cycles into Asia begin slowdown. There will be tremendous demand for balanced portfolio diversification with a strong emphasis on tourism dollars and global services. China may dominate the manufacturing supply chains but the US dominates services supply chain which is 40% of global GDP. In 2021 the US will be strengthening its infrastructure and globalizing its services sectors. Most transitional countries have invested heavily in developing their infrastructure and global competitiveness while blocking the US from competing in their service sectors. The relationship between services growth and overall economic growth has become stronger in the past few decades. In 2015 the service sector accounted for 74% of GDP growth among mature countries and among transitional countries it jump from 48% (1997)to 57%(2015). Except for a few major developing nations such as China, Indonesia, and India, the service sectors contributed over 60% percent of the total value added to GDP. In the US services contributed to 79% percent of the GDP growth in 2018. In fact service exports worldwide grew faster than manufacturing exports over the last decade. Germany and Singapore have negative trade in services balance, while they are net positive in trade of goods. While the financial services industry was the fastest growing of global services sector. Travel and Tourism is the second fastest growing sector globally. The strategy for the US at this stage of the global capital flow cycle is creating the right technology and human capital to gain more global growth from services. In fact the tourism sector employment is already larger than the manufacturing, automotive and chemical sectors combined. The tourism sectors 105 million people combined and it is 4 time more than global banking, 7 times more than auto manufacturing and twice the size of global financial services. Oxford School of Economic predict that tourism will grow by 4% percent globally every year over the next decade. In 2018 tourism rose 3.8% to almost $13 trillion US dollars. Singapore, Dubai, London, India and EU are all developing their infrastructures for future capital flow. Even Saudi Arabia one the most wealthiest global surplus nations has open itself to international tourism and expanded their hospitality infrastructure. Please see Chart below for top tourism countries.

For global portfolio diversification, we like US hotels and infrastructure asset classes for CRE portfolio diversification for 2021 thru 2024.In 2019 we expect the global hotel transaction volume to reach $68 Billion US dollars , which will be a slight increase year over year. Although we expect slowdown in CBD major market select service hotels and but marginal growth in upper scale hotels. With most slowdown is due to room supply expansion in CBD hotels. We like Atlanta, Phoenix, Denver, Nashville and Dallas-Fort-Worth-Austin areas of the US hotel Market for 2019 thru 2023.The hotel development landscape in the greater Dallas area will be widely active in 2018-2023, spanning from the CBD to the northern suburbs; the metropolitan area has welcomed significant amounts of new hotel supply with only modest contractions in occupancy and, despite some slowdown, ADR growth remains positive. In addition to existing corporations reinvesting in their facilities, the DFW area has laid a welcome mat of aggressive incentives, complemented by the State’s lack of a state income tax or corporate income tax; in turn, the area has attracted new corporate giants such as Toyota, Liberty Mutual, and Uber, as well as professional sports organizations such as the PGA of America. New hotel product continues to elevate the market, bringing new and returning brands to the Metroplex area of the city. Phoenix continues to exhibit extra growth, with RevPAR growth above the national average. Despite challenges the area hotel operators have been able to push rate more than most major markets. Furthermore, new development has increased in certain outlying submarkets, such as Gilbert and Mesa.

In 2019-2022 the Nashville hotel market will be attracting capital flow to the CRE investment cycle. announcements from Amazon, EY, Smile Direct Club, Alliance Bernstein, and Philips to add 9,300 combined jobs in Nashville have continued to buoy occupancy levels despite a nation-leading new supply pipeline of over 125 new hotel projects. Moreover, Nashville International Airport’s ongoing $1.2-billion expansion continues to make it more accessible nationally, nearly doubling airport traffic from a decade ago, and eventually internationally, upon the opening of a new international arrivals’ terminal in 2020. There are lots of exciting hotel projects in Los Angeles between now and 2021, almost 40 will open, with 15 of that number being finalized this year. The US hotel investors are preparing infrastructure for the global tourism competition. Now we need a government infrastructure program to update other aspects of the US infrastructure such as roads, bridges, energy, big data and the training of human capital to expand the US global services . The inability to pass the 1 trillion dollar infrastructure program has impose large costs on the U.S. economy. In addition to the threat to human safety of catastrophic failures like bridge collapses or dam breaches, inadequately maintained roads, trains, and waterways cost billions of dollars in lost economic productivity. The delays caused by traffic congestion alone cost the economy over $120 billion per year. Airports are another choke point: international tourism supports 1.2 million U.S. jobs and brings in hundreds of billions of dollars of tax revenue. But some studies have found that delays and avoided trips due to the poor state of the nation’s airports cost the US economy. The US infrastructure program has garnered many private investors from around the world from Saudi Arabia which has invested 20B with Blackstone for US infrastructure to Japan offering to invest large amounts of pension fund capital.

Also, look for private equity to move towards consolidation in 2019. In 2018 a total of 703 billion dollars of capital flow was committed to private equity which stands at 12 percent below 2017’s record of $800 billion. A review by PERE found that 2018 was the worst year for private equity capital raising in the last seven years. The trend for smaller PE firms will be co-investing in 2019. The US private equity manager is looking at core office, infrastructure, data centers, office, alternative assets, senior health facilities and e-commerce driven industrial. On average private equity returns 8.2 percent which outperforms equity indexes. The hybrid funds will continue to find investors; Apollo just raises 3 billion for its Value Fund a mix of equity and credit. Although capital inflows to CRE debt funds fell by 48% after peaking at $39 billion in 2018. Pension funds will be forced to allocated larger funds to private equity with global skills to meet benchmarks. However, with the scale of deal size private equity must look to global diversification in 2019-2021. This means China, India, Brazil, GCC global logistics and outbound markets east with transparent policies supporting foreign direct investment and financially integrated systems.

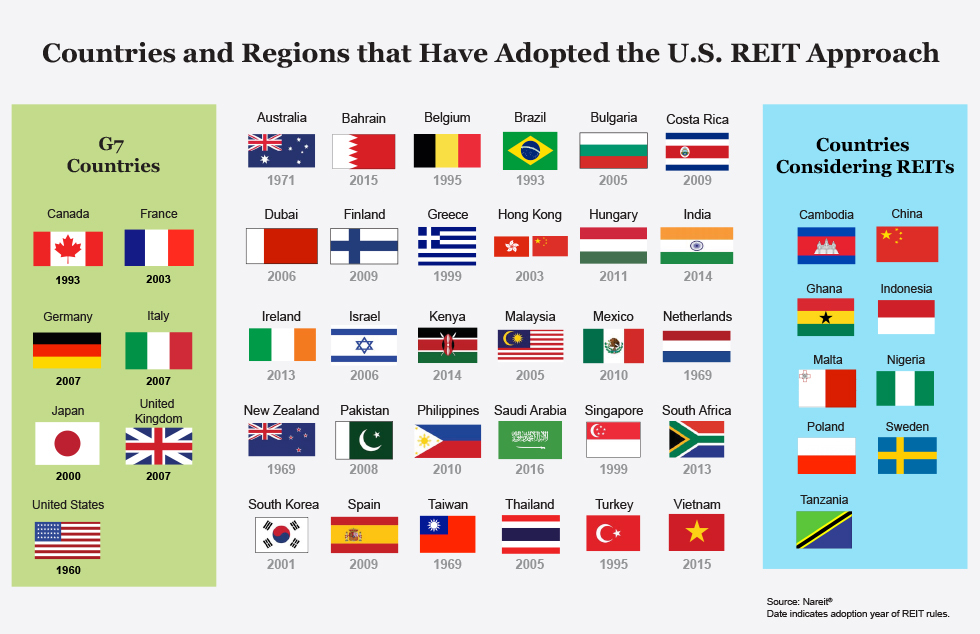

In 2020 -2021 Basar Global Group (BGG) sees REIT s as the primary global vehicle for smaller US funds to participate in global diversification of commercial real estate assets. REIT s can expand and diversify the investor pool.REIT’s can take advantage of the separate Global Industry Classification Standard (GICS) of real estate and help generalist investors to better understand the nuances of REIT’s performance, operations, and valuation. Companies can frame a targeted expansion strategy for generalist investors such as pension, endowment and foundation funds who have been traditionally under-allocated to REIT s but are warming up on REIT investments.

Further, the increased investor interest can particularly help smaller REIT’s gain exposure to more institutional investors, as the investors plan to expand beyond core markets in search of yield. For example Pension fund respondents to the Deloitte survey, plan to increase CRE capital commitment by 9 percent in the next 18 months, and a significant portion of this could be directed toward REIT s. Portfolio managers are able to use data insights to achieve geographical diversification by targeting investors from different markets and countries. REIT”s would also be a good partner for private wealth such as family office seeking CRE portfolio diversification. Blockchain will support dividend and currency transactions will be an “ideal use” of blockchain for REITs, “as are applications around securities, land deeds, voting, registries and identity management.” He notes that “the maximum potential of blockchain in REITs will be unlocked once the entire real estate life cycle is transitioned onto the chain.The REIT platform continues to expand in developing markets.

FAMILY OFFICE INVESTMENT TRENDS 2018-2023

When considering the current property trend for a family office. In the US one would think in terms of value added multifamily, suburban offices, and social impact zones. For example, the US apartment market has long legs to run according to Multifamily Housing Council MFHC studies show the US is in need of 4.6 million new apartments by 2030 while they are currently under producing unit demand by 100,000 apartments.

This would direct investment sales in the US to private wealth which hold smaller size property assets for longer periods. Both the bond market and hedge fund performance has been dismal for private wealth investors. In the US the apartment sector is the new hedge to safety with a dovish Fed on pause. It appears to be a” perfect storm for family office CRE investors. During the ” to hot to trot nineties” we had capital flow from the institutional investor, then came sovereign wealth and private equity run, the next 10 years will be the family office run. According to Real Capital Analytics(RCA), private wealth represented 34% percent of the commercial real estate market in 2017. Some of the private wealth coming to the US will be from Mexico, Brazil and some Shariah compliant from GCC merchant families.

In a UBS survey, 39% percent of family office stated that they plan to invest in opportunity zone funds. The top apartment markets for 2019 are Minneapolis, San Jose, Orlando, Columbus, and Phoenix. The apartment market will face challenges of flattening rents and abundance of Class A apartments being constructed in tertiary markets. Many people have floated the idea of offering investors fractionalized ownership of US commercial real estate. As a result, the value of US real estate could continue to rise, however, this could price US small investors out of the market. If you are in a pre-downturn- don’t wait- you must have sufficient cash reserves-frontload your large property repairs- take look at loan terms, most investors lose their property not because they cannot pay mortgage but because they cannot get refinancing- your banker will not respond to calls, if one decides to peak sell, change property type in a (1031ex) to avoid capital gains .